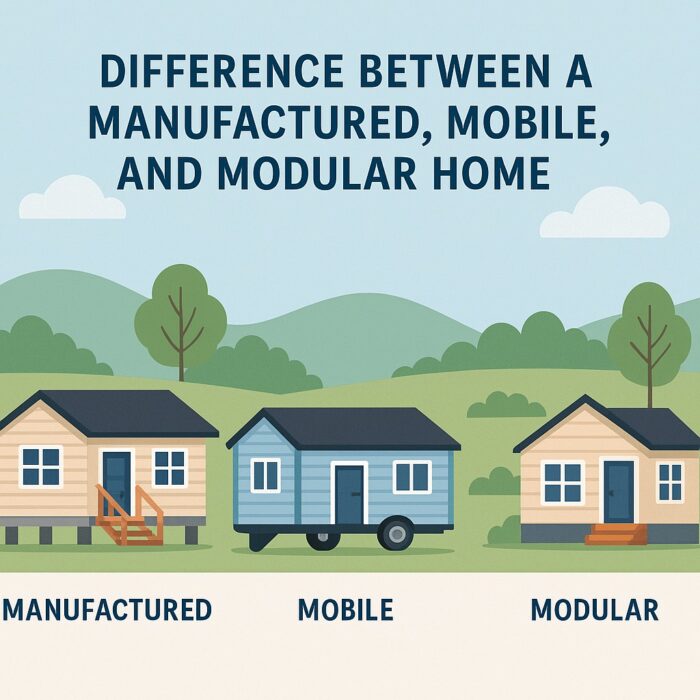

If you’re researching affordable housing options, you’ve probably come across terms like manufactured home, mobile home, and modular home. These terms are often used interchangeably, but they refer to different types of homes. Each comes with its own construction process, financing options, and ownership considerations.

Knowing the difference is important—especially if you’re applying for mobile home loans or looking into modular home loans.

Let’s break down what each home type means and how that affects your financing and long-term plans.

What Is a Manufactured Home?

A manufactured home is built in a factory and delivered to a site for installation. These homes follow federal construction standards set by HUD since 1976.

Key facts:

- Built entirely in a factory

- Delivered in one or more sections

- Must meet HUD code requirements

- Typically placed on either owned or leased land

Today’s manufactured homes often feature full kitchens, bathrooms, and multiple bedrooms. They may look like traditional houses, especially when placed on a permanent foundation.

Looking for a manufactured home loan? You’ll find several programs at eLEND that serve buyers with a range of credit profiles and land ownership situations.

What Is a Mobile Home?

The term “mobile home” technically refers to homes built before June 15, 1976. That’s when the federal HUD code went into effect. These earlier homes do not meet the same construction standards as manufactured homes built afterward.

Key facts:

- Built before June 15, 1976

- May not meet HUD safety codes

- Often harder to finance or insure

- May need upgrades to qualify for a loan

If your home was built before 1976, it’s still considered a mobile home. Getting a mobile home loan for this type of property can be difficult. You may need to refinance or upgrade the structure to qualify for better financing.

What Is a Modular Home?

Modular homes are also built in factories, but unlike manufactured homes, they are constructed to meet local building codes, not HUD standards.

Key facts:

- Built in sections in a factory

- Assembled on-site on a permanent foundation

- Must meet state and local building codes

- Treated like site-built homes for financing and appraisal

Because modular homes meet the same standards as traditional homes, they are eligible for more conventional loan programs, including modular home loans with fixed rates and long terms.

Want a home that appreciates like a stick-built property? Modular may be the best choice.

How to Tell the Difference

Look for a metal HUD tag or data plate inside the home. Manufactured homes have these. Modular homes do not—they instead have labels from local inspectors.

You can also look at the foundation:

- Manufactured and mobile homes may sit on blocks or piers.

- Modular homes are placed on permanent foundations and are harder to move.

Comparing Financing Options

The type of home you choose affects your financing options. Here’s a breakdown:

Mobile Home Loans

- May be limited if the home was built before 1976

- Often require chattel loans if on leased land

- Some mobile home loan programs available through eLEND

Manufactured Home Loans

- Qualify for FHA, VA, and USDA programs

- May require permanent foundation for mortgage eligibility

- Learn more at ManufacturedHome.Loan

Modular Home Loans

- Qualify for conventional mortgage loans

- Treated like site-built properties

- Available through eLEND

Looking for loan options? Both sites offer tools and support to help you choose the right path.

How Land Affects Your Loan

If the home is located on land you own, you may qualify for a traditional mortgage.

If it’s in a park or on leased land, you may need a chattel loan or a personal property loan. These often come with shorter terms and higher rates.

Compare chattel loan options if your home is not permanently affixed to owned land.

What About Refinancing?

Refinancing depends on your home’s type and your land situation.

- Manufactured home refinance options include FHA, VA, and USDA programs.

- Modular home refinance options are similar to site-built homes.

- Mobile home refinance may be possible through chattel loan programs if built before 1976.

Use refinancing to lower your monthly payment, reduce your rate, or switch from personal property to a mortgage.

Which Type of Home Is Right for You?

Here are some questions to ask yourself:

- Do you already own land?

- Are you comfortable living in a mobile home park?

- Are you focused on long-term appreciation?

- Do you need a loan with low down payment options?

Your answers can help you choose between a manufactured, mobile, or modular home. If you’re still unsure, talk to a lending expert at eLEND.

Frequently Asked Questions (FAQ)

Can I finance a home that’s not on a permanent foundation?

Yes. Chattel loans are available for homes on leased land or mobile home parks. See home loan options at ManufacturedHome.Loan.

Are modular homes treated like real property?

Yes. Modular homes are financed and appraised the same way as traditional site-built homes.

What is the difference between FHA chattel loans and a mortgage?

FHA chattel loans apply to personal property, while FHA mortgages apply to homes on permanent foundations.

Can I refinance from a chattel loan into a mortgage?

Yes, if you meet the foundation and land ownership requirements. See manufactured home refinance options.

Are there loan programs for first-time homebuyers?

Yes. FHA, USDA, and VA all offer options with low down payments. Learn more at eLEND.

Can I buy a modular home with a regular mortgage?

Yes. You can use a modular home loan to finance your purchase like a traditional home.

If you’d like help comparing mobile homes loan options or want to apply today, start with eLEND or ManufacturedHome.Loan.

Let the structure that suits you also support your future.

Lender NMLS: 2826

Trade / Service marks are the property of American Financial Resources, LLC DBA eLEND and ManufacturedHome.Loan. Trade names may vary by state. For more information, please visit here. Some products may not be available in all states. This is not a commitment to lend. All loans subject to credit approval. Equal Housing Lender.